2021 has been without a doubt a difficult year for a lot of industries around the world, and the whisky industry is no exception. Scotch Whisky Association’s public data has shown that Scotch Whisky export value, despite having grown by 21% in 2021, is still 8% below pre-pandemic levels in 2019.

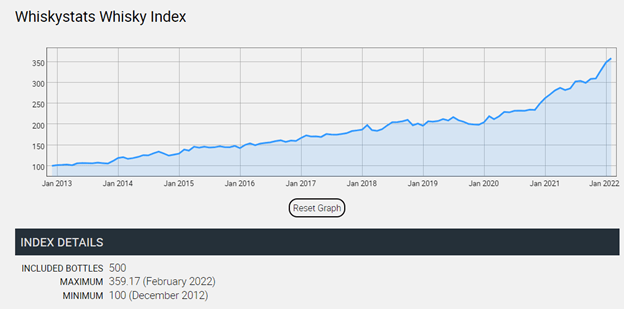

With these numbers in mind, one might assume whisky prices would have dropped. This is however not the case. Historical data has shown that alternative and physical assets have always performed well during economic crisis, and whisky is no exception. In both 2020 and 2021, whiskies that are traded in the secondary market (online and physical auction houses) have shown some of the biggest growth ever, currently hitting historical high according to Whiskystats whisky index. Why is that the case?

Natural scarcity

New whiskies are being distilled every day, and distilleries have been increasing their production capacity to cope with scotch’s growing popularity for many years now. However, when we look at whiskies, not all whiskies are born the same. Each distillery, each individual label, are often treated as completely different products in the eyes of connoisseurs and collectors. Different labels, different age and different distilleries are therefore not considered as substitutes. Distilleries can always increase production to meet future demand for the new generation of drinkers, but old whiskies and aged whiskies can never be truly replicated. When we are looking at investment grade whiskies that appear in auctions, there are the types of whiskies we are looking at, which were created under very limited quantity, and ever decreasing, hence its scarcity must increase over time, independent of any external economic factors.

Rigid prices even in the worst of times

An important characteristic about luxury goods as an alternative asset is that it is rarely being treated as an investor/collector’s main asset in his/her portfolio. In the case of whisky, with most collectors also being experienced drinkers, a lot of their collections were also acquired partially out of passion, rather than a pure rational investment decision. Therefore, alternative asset investors would often be much more reluctant to sell and cash out this part of their portfolio when they need that extra liquidity, compared to their main portfolio such as stocks and properties which not only do they have no emotional attachment to, but also makes up for a much larger proportion of their portfolio. Due to the passionate nature of these investments, whisky prices tend to stick their ground even during the financial crisis.

Irrefutable historical status of classic whiskies

Unlike most financial assets, there are other forms of intrinsic and intangible values associated with alternative assets like whisky, fine wine and art. The taste, brand and artistic values associated with them are once again independent of external economic factors. Whilst the value and status of a stock can rise and fall any time due to the company’s performance, a classic, well reviewed high quality whisky does not. Imagine a bottle of 1958 Macallan 18yo, the historical status and artistic value of a classic whisky like this doesn’t change regardless of what Macallan as a company does today. The old and rare whiskies have stood the test of time, and with these perceptions embedded in the collector’s minds, they tend to be unaffected during economic uncertainties.